Investment Strategy

Counterpoint pursues opportunistic and deep value-add projects in emerging neighborhoods. Often making fringe investments that flanks significantly larger private, public, and institutional, investment initiatives. Monitoring investment activity by entities such as the Philadelphia Housing Authority, often leads Counterpoint into new opportunities situated within Qualified Opportunities Zones (QOZs), which serve to further enhance investor returns through the eligible capital gain tax deferral legislation.

It is the aggregate of these investment efforts in these underserved communities which ultimately restores vibrancy, amenitizing the neighborhoods Counterpoint is working within helping to make them desirable places to live.

Primarily focused on multi-family assets, Counterpoint targets aging Class C, but well situated properties in highly amenitized neighborhoods with convenient access to public transportation.

This approach exposes Counterpoint projects to above average capital appreciation, as well as access to tenant flow transitioning in and out of Class A and Class C multifamily properties during the ebbs and flows of normal economic cycles.

Sponsorship takes a hands-on approach to construction management always striving to drive costs down to maximize project performance. Counterpoint seeks to establish long term relationships with materials and labor partners often through factory-direct buying channels.

Current redevelopment construction activities are geared towards buying existing shell structures, below their replacement cost, as this continues to offer a sheltered hedge against rapidly escalating construction materials costs, and inflation.

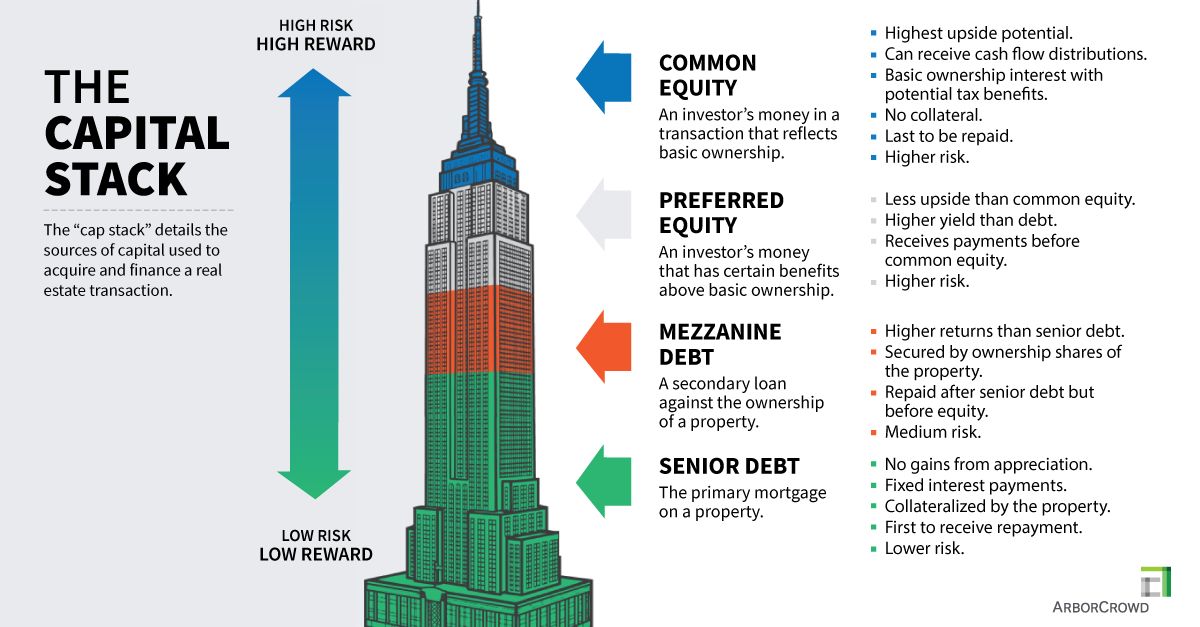

While there is no single project finance structure, our capital stack on any given project allows investors to participate in preferred equity, common equity, and senior debt. Counterpoint approaches its investment choices with the full project life cycle performance in mind prioritizing cash flow and capital appreciation during the asset life cycle.

Adaptive reuse through property redevelopment

Re-entitling land to be built, or sold

Multifamily asset class has demonstrated over recent decades, and longer, to provide reliable returns for well-conceived projects.

Multifamily asset class seems to climb steadily decade after decade, avoiding the boom and bust cycles of other real estate asset classes.

Disclaimer: This material presented on Counterpoint’s website is for informational purposes only and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that we consider reliable, but we do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. Our views and opinions expressed in any website content are current at the time of publication and are subject to change